If you’ve used Chase banking for your entire life, you might be hesitant to set up an account at a newly established bank. Your preference for a familiar banking institution is demonstrative of the Lindy effect—a tendency to favor long-standing, non-perishable things. The Lindy effect spans technological concepts, businesses, products, and cultural preferences such as the construct of money.

Take another example of a newly established village versus a centuries-old city. When comparing the likelihood of which township will stand the test of time, the Lindy effect proposes that the more aged the province, the greater the likelihood of its enduring into the future.

We observe the Lindy effect manifesting consistently across various domains, such as music and literature, but its influence is most deeply ingrained in our personal lives when it comes to commerce and currency. We tend to trust age-old institutions and traditional forms of value, be they banks with a long history of stability and reliability, or tangible assets like gold, which has long served as a bulwark for markets.

#Lindy In Crypto

In cryptocurrency, few protocols exemplify the Lindy effect so distinctly as Bitcoin. As a first mover in blockchain-based assets, it sets the bar for all other cryptocurrencies. Bitcoin’s 15-year undisputed reign, endured despite the rise of countless protocols aiming to take its place, embodies the essence of this principle. Bitcoin serves as a vivid testament to the Lindy effect's predictive power in digital finance.

As Bitcoin illustrates the Lindy effect through economic prowess, the same can be said of the technology behind the blockchain and network’s security model, both of which have yet to suffer a critical failure or breach since deployment. This puts Bitcoin in the unique spot of being markedly more established than the slew of recently emerged boom-and-bust token rush ghost towns.

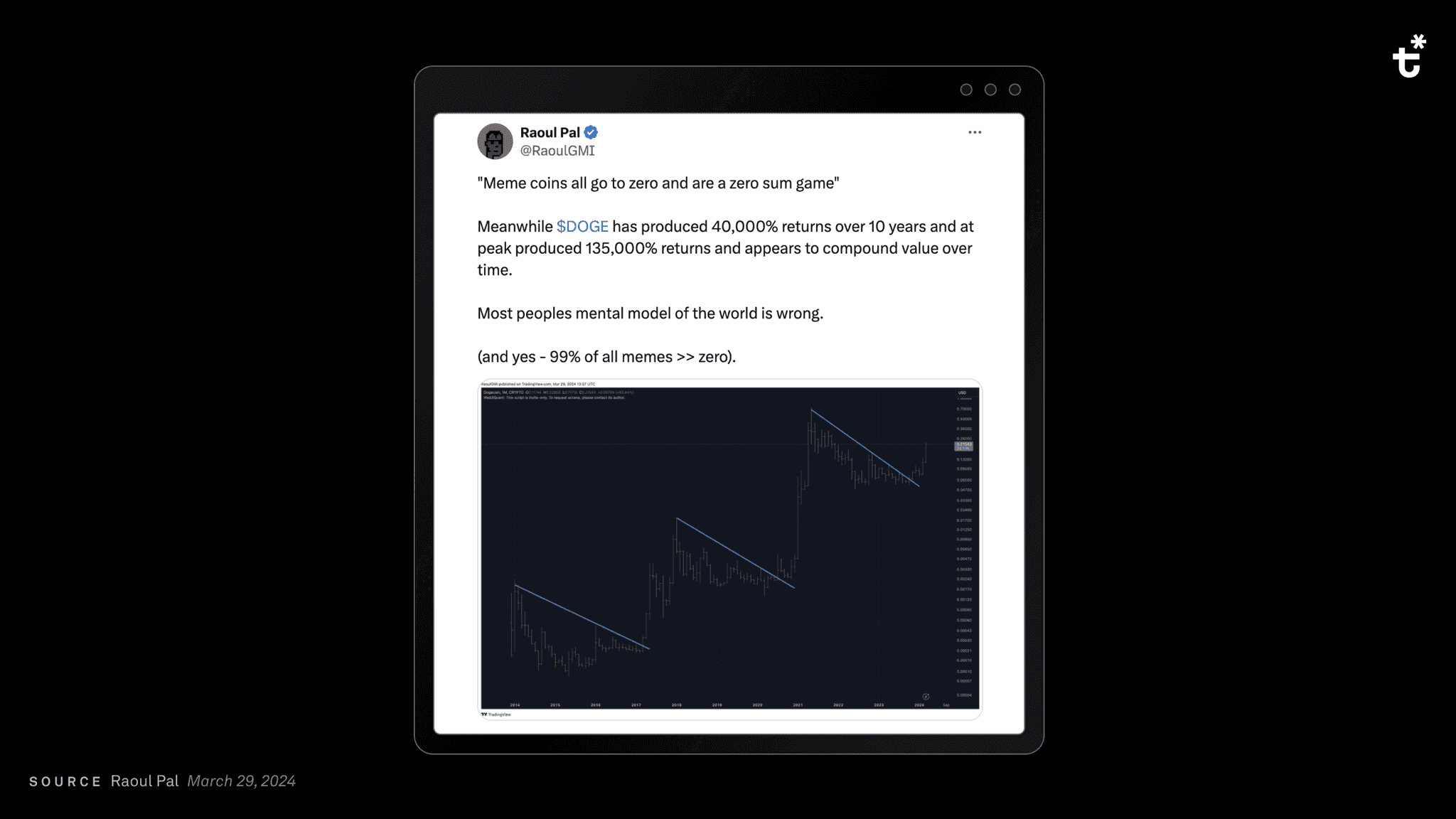

Yet there are other cryptocurrencies also demonstrating the Lindy effect. Dogecoin, which started as a joke, went on to spark an entire culture of meme-coins. Now, Doge is among the most recognized cryptocurrencies alongside bitcoin, with its own set of devoted followers.

Despite the jest from which it originated, as Raoul Pal’s commentary points out, Doge is now a longstanding cryptocurrency, consistently within the top 10 by market capitalization, and has maintained a steady growth pattern over the years.

Doge and Bitcoin are clearly embodiments of the Lindy effect manifesting itself in crypto markets. But what about newer launched coins, like Aptos? PEPE? OHM? BEAN? Who’s to say that any of them will be around in 5 years? Taking a chance on these newer tokens is riskier, just like doing so with Doge at the time was a risk.

If 5 years from now some of these ecosystems are still seeing "success" (which is a vague statement in itself), it is much more likely and reasonable to say they will be around for another 5 years.

#Thesis

Just as a handful of cryptocurrencies capture Lindyness (and others not so much), only a few institutions in crypto do so as well. Thesis, with over a decade of work fortifying the blockchain industry, stands among the resilient cadre of crypto organizations to epitomize the Lindy effect.

Our work encompasses numerous open-source offerings, including core contributions to tBTC, and consumer-facing applications such as Taho and Fold.

As a builder of freedom technology, our work resonates with Bitcoin’s core tenets—a secure, decentralized, and immutable network that is widely accessible to all participants. Our core principles embody these elements.

Our building standards hold to these values as we create a similarly trust-minimized, user-centric ecosystem of Bitcoin-first bridges, brands, tools, and applications.

The enduring success of any entity in crypto hinges not just on its alignment with systemic values but also on its ability to grasp the ecosystem’s present challenges and what it requires to overcome them. For Thesis, our capacity stems from a decade of building resilient blockchain products.

#Fold

Marking the inception of Thesis in 2014, Fold has helped break down the challenges of integrating Bitcoin into daily life with unique BTC rewards and investment incentives. Fold vividly illustrates how Thesis, and by extension, the products we build, are in alignment with the underlying principles of the Lindy effect.

Fold reinforces long-term financial planning with its BTC Rewards Debit Card, a cornerstone of our offerings to both consumers and Bitcoin investors. It promotes the development of spending habits geared towards financial security and longevity—users allocate BTC savings with every swipe. Using Fold, with each purchase you can prioritize your financial longevity, and thus personally attune to the Lindy effect.

#tBTC

Built by a team at Thesis, tBTC is a unique Bitcoin bridge unlike anything else on the market today. Powered by Threshold Network, tBTC is a heavily audited and well-documented platform whose tech helps bitcoin reach across the Web3 ecosystem.

tBTC is secured through a trust-minimized model involving stakers of Threshold's native T token and is managed via smart contracts, holding to the autonomous and decentralized principles of Bitcoin. With its approach, tBTC extends BTC to networks including Solana and Ethereum, further amplified via a strategic partnership with Wormhole.

A strong demonstrator of the Lindy effect, tBTC now has nearly $200 million in value locked and has securely and safely bridged bitcoin in its 4 years of operation. Yet tBTC’s path forward was iterative. Today’s tBTC accounts for the lessons learned from its previous deployment, tBTC v1, which used a model based on over-collateralized reserves to back BTC wrapped onto Ethereum.

Although tBTC v1’s methodology technically worked as a means to bridge BTC, the high cost of providing greater than equal collateral to secure those tokens ultimately introduced capital ceilings—an obstacle to scaling. With this in mind, we re-engineered tBTC v2 to overcome capital limitations via a system that relies on the probabilistic and statistical guarantees of distributed and randomly assigned signers.

Taking lessons from the market to improve our products is expressive of Thesis’ adaptability, which is a key factor to our decade-long success in the industry.

#Join Thesis

With this long-standing history, the principles of the Lindy effect are on our side. This is especially true in crypto markets, where 1 week feels like a year; a decade of consistent and dedicated building on Bitcoin means a lot.

Engage and become a part of the Thesis community as we continue to push operational standards and initiatives that grow the value, security, and productivity of decentralized systems for all.