Satoshi Nakamoto’s vision for Bitcoin positioned the blockchain as a peer-to-peer payment system meant to overcome the double-spend dilemma faced by earlier digital settlement networks. Bitcoin’s solution captivated the world over—a decentralized, immutable, permissionless network secured by Proof of Work consensus (PoW), free of human intermediaries. The notion of “not your keys, not your coins” has birthed a new industry-standard concept of self-sovereign currency.

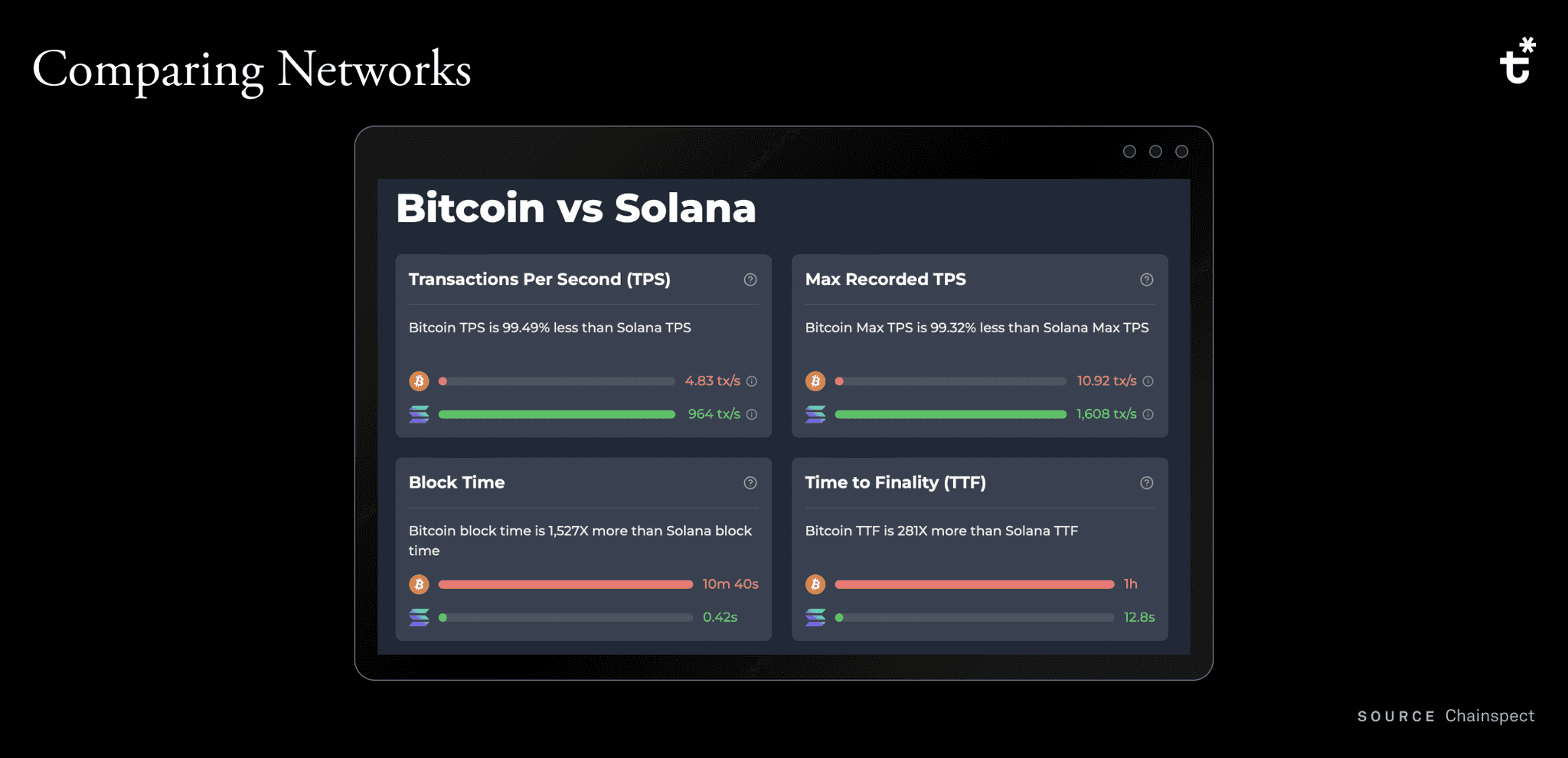

However, the network’s decade-long journey toward mainstream adoption is making fast apparent the gaps in its technical capacity and a global payment system’s needs. So despite the aspirations upon which Bitcoin was built, as a settlement layer, it simply cannot compete in the rapidly expanding digital world—Bitcoin’s ~7 transactions-per-second (TPS) pales in comparison to the ~4,000 TPS that mainstream networks like Visa are capable of processing. Even among other blockchains, Bitcoin’s time to finality, or the amount of time it takes a block of transactions to become validated and immutable, also lags; counterparts such as Ethereum's 15 TPS or Solana’s nearly 1,000 TPS show Bitcoin’s value is far from tethered settlement-based metrics.

These were never closely held secrets; even Nakamoto conceived of workarounds to scaling Bitcoin, such as alternative merged mining networks. With greater adoption of Bitcoin, the escalating transaction costs price out participants—for instance, if it costs $100 to send $1,000 on Bitcoin, the large majority of the global population will never be able to use the chain. Scaling obstacles were the catalyst for existing Bitcoin L2 platforms such as the Lightning Network, and remain driving a factor in the prevalence of centralized or custodial routers for BTC.

Still, even with the transactional efficiency exhibited by various competing blockchains, none have managed to embody the concept of hard money quite like Bitcoin. Its distinct blend of scarcity, decentralization, and security has established Bitcoin as the new standard for “digital gold” in a world that is increasingly accepting the viability of crypto assets.

Falling short of achieving Bitcoin’s status as digital gold—given the transactional prowess afforded by other blockchains—helps to make the point that the path forward for a Bitcoin-based payment system lies not on alternative L1s, but on a Bitcoin-aligned Layer 2 (L2) network.

A Bitcoin L2 solution enables BTC to overcome on-chain congestion and the high costs associated with transactions, paving the way for a more efficient and scalable payment system that benefits from Bitcoin’s dominant position in crypto.

#Why Bitcoin Won’t Work

#Quantum Cats Mint Case Study

Udi Wertheimer laid out some of the pain points of merchants attempting to directly interface with Bitcoin through the lens of the Quantum Cat’s deployment—an Ordinals collection whose design is to reignite the long dormant OP_CAT scripting function, whose proponents say will make the Bitcoin network more functional at the base layer.

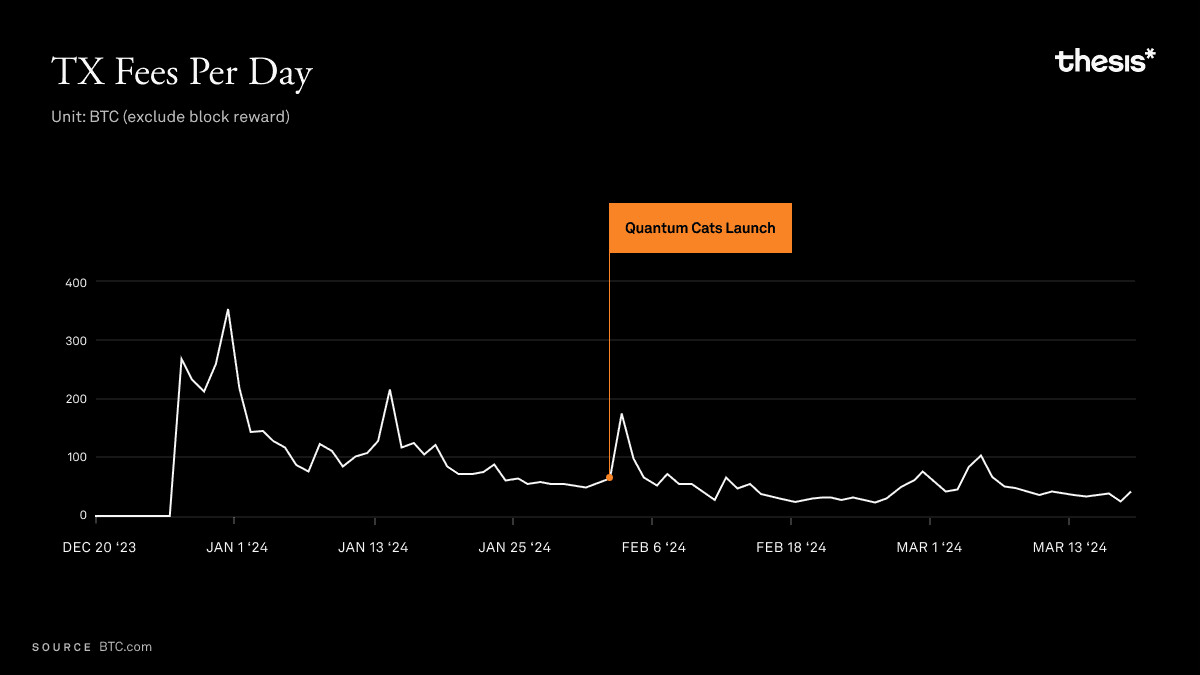

The Quantum Cats launch saw over 300 BTC processed directly on the network, roughly equivalent to $15 million. However, of that, nearly 20 BTC, or over $1 million, went to refunds resulting from several inefficiencies associated with Bitcoin’s architecture, an impactful financial burden for merchants when compounded with network transaction fees.

#Game Theory and Payment Enforceability

Driving the million-dollar-plus refund rate of Quantum Cats’ launch are the complex strategies employed by participants in the sale. One factor in those strategies comes down to confirmation times. With uncertainty of the outcome of a transaction and high demand for a good, users often send multiple orders to secure their acquisition—even if purchase limits restrict the quantity of items a user is allowed to buy.

Outside of filling multiple carts and hoping for the best, some users resorted to simply overpaying to see their transactions prioritized. Others opted to underpay in a bid to game the system and see if they might get their order filled anyway. These cases arise due to the lack of payment enforceability, meaning that a merchant cannot enforce a structure on what kinds of payments a customer wants to send. In either case, those customers must be refunded, burden that the merchant must take on.

For merchants transacting directly on Bitcoin, reconciling this isn’t as quite as easy as making change; it requires significant manual oversight and sophisticated software to track and manage payments, after which processing refunds is time-consuming and costly.

#Surging Fees

Network fees scale with demand. This unpredictability in fee prices makes it difficult to accommodate from an accounting perspective for merchants, who may be paying different fees on a per-block basis depending on how their transactions settle. Fee volatility hinders the automation of refunds for merchants seeking to cut costs by timing outbound transactions with market inactivity, significantly increasing both the financial burden and the time required for merchants to develop solutions to overcome these obstacles.

#Other Scaling Options

Quantum Cats' exploration into the Lightning Network as a potential solution revealed that, while LN might address some issues of speed and cost, it falls short in supporting the volume and nature of high-demand sales. The project's need for incoming liquidity and the network's total capacity limitations exemplify the practical challenges of relying on LN for large-scale, high-demand transactions.

The crux of the issue lies in the LN's requirement for "incoming liquidity." To facilitate transactions, other nodes within the network must earmark a substantial amount of Bitcoin. In the case of Quantum Cats, that amounted to at least 300 BTC, around 10% of the LN's total capacity. Considering the diversity of potential customer service providers, pushing the requisite total to lock up for smooth operations to around 1000 BTC or more, would account for over 25% of LN's capacity, which simply isn’t feasible.

#Support for Bitcoin as a payment platform is weakening

Coinbase may let you buy BTC, but does it take payments in it? Brian Armstrong made waves in February this year with criticisms over crypto payment UXs in the same quarter, it came out that Bitcoin L1 payments simply wouldn’t cut it for Coinbase.

It was part of a sweeping change to Coinbase’s Commerce product that deprecated payment support for BTC along with other forms of unspent transaction output (UTXO) tokens. Again, the culprit here is Bitcoin’s rigid infrastructure, which falls short in the face of other protocols capable of leveraging smart contracts to convert payments on-chain at guaranteed rates.

#Lightning Network

The Lightning Network (LN) represents significant time and effort spent towards building scaling mechanisms atop Bitcoin. By processing transactions off-chain to reduce pressure on Bitcoin, and enabling instant payments between nodes on the network LN takes major strides toward usability. For certain use cases, LN remains a viable solution.

However, on the mercantile front, there remain limitations with LN that constrain it from being used as a payment network. When using LN in a campaign where 10,000 people made $2 payments over a weekend, the resulting network stress compelled several CEOs of wallets and services providers to push back, calling for a halt.

Lately, LN has seen fracturing in its core development team as well. Antoine Riard, a security researcher and developer for the Lightning Network, stepped back from his role due to what he describes as a "hard dilemma" facing the Bitcoin community. According to Riard, a new class of replacement cycling attacks poses a serious threat to the LN and he suggested that addressing these vulnerabilities could require changes at the Bitcoin protocol level itself.

Anton Kumaigorodski, who was involved in the development of the first mobile lightning wallet, also opted to publicly step back from LN. Kumaigorodski's departure was motivated by concerns over the network's increasing complexity and his capacity to contribute meaningfully to its development.

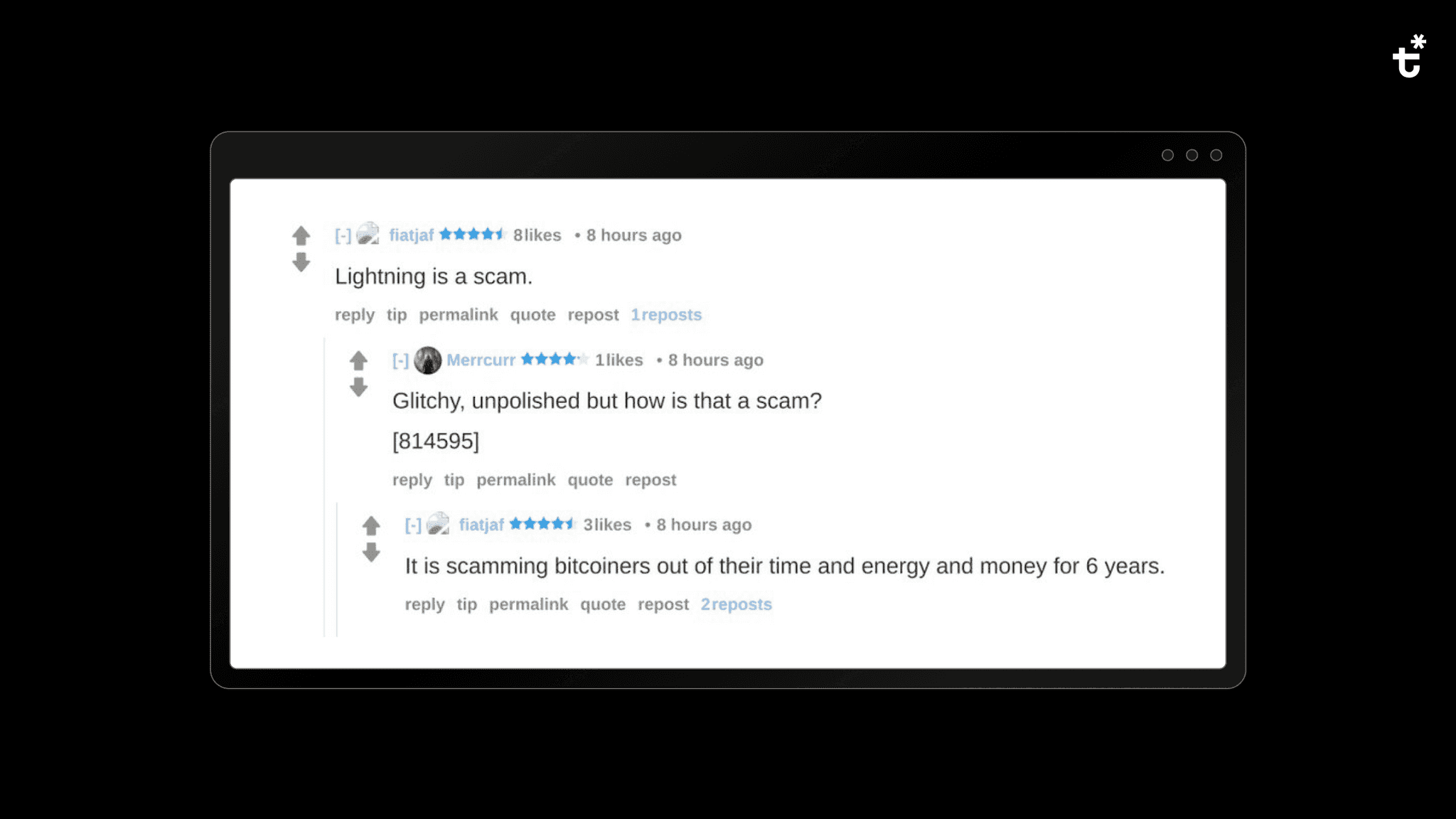

LN also faced criticism from fiatfjaf, creator of the open decentralized social media protocol Nostr, who had some choice words for the L2 solution:

Of course, LN isn’t the only protocol that is working to scale Bitcoin so it can handle payments, but they are not without drawbacks or operational complexities:

#Rootstock

- Uses RBTC for transactions, maintaining a 1:1 peg with BTC.

- Relies on centralized custodians for RBTC's security.

- Employs merged mining, potentially centralizing mining power.

#Stacks

- Undergoing overhaul with Nakamoto hard fork to change its consensus mechanism.

- Moving towards a miner/validator-based mechanism

- Broadcasts a hashed record of Stacks network history to Bitcoin, marking significant shifts in operations

#Liquid Network

- Faces centralization risks due to its federation model

- A select group of functionaries controls transaction validation and block signing, diverging from Bitcoin's decentralized ethos

These networks are striving to scale Bitcoin, but a relative lack of demand across them indicates that none of these L2s have successfully solved the Bitcoin payment dilemma.

Bitcoin can't be a payment network, but an L2 can and will be a justifiable way to transact with BTC. People should own their money and be able to use it, and correctly built L2 will make this happen—we just haven’t seen it happen yet.

#Usable Bitcoin

The concept of “using your bitcoin” may seem contradictory for an industry that was built on the concept of HODLing strong and never selling. But the reality is, bitcoin is the best form of money available today, both from an asset perspective and fair distribution, so we should be able to use it in the real world for real things.

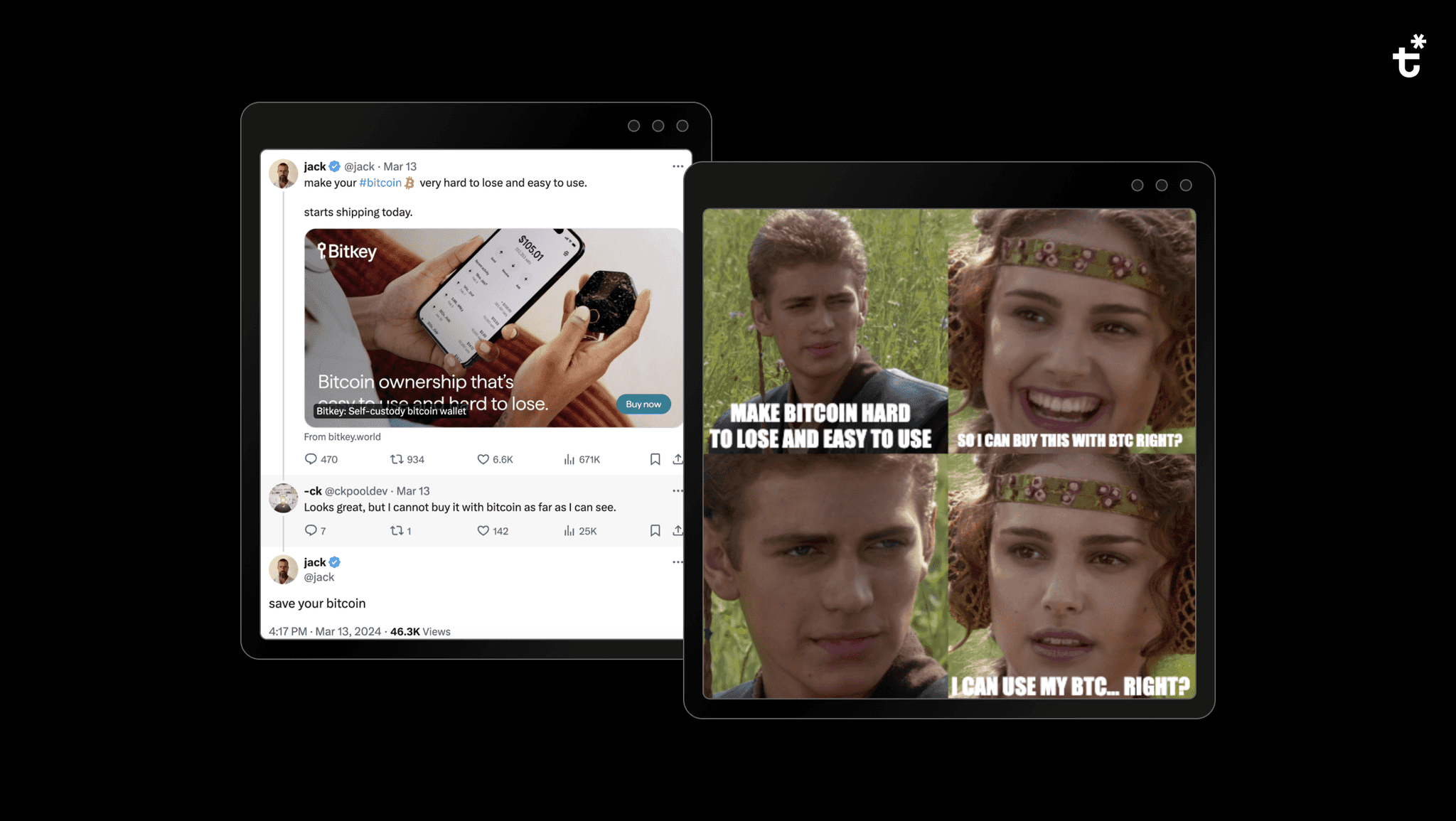

Still, we have become conditioned to not think about using bitcoin because of the culture of HODL. This concept is best explained through Jack’s recent launch of BitKey, a self-custodial bitcoin wallet.

You should be able to use your Bitcoin...

#Payment aligned Bitcoin L2s

With the development of Bitcoin’s L2 landscape and the solidified status of BTC as the quintessential asset, these L2 network solutions will emerge as necessary advancements to address the critical challenges of Bitcoin as a base payment layer.

With its saturation of mindshare, BTC is the natural asset of choice when it comes to onboarding new users to crypto, and the only way to bridge that gap between non-crypto natives and BTC is through Bitcoin L2 networks capable of facilitating the robust payment channels necessity to foster and support that adoption.

For the future of Bitcoin and as a bridge to the new economic layer that will support consumer adoption, Bitcoin L2s represent a juncture that reconciles its foundational principles with the practical needs of a growing user base.