August 28, 2024

Welcome to BitcoinFi Weekly. We cover where people use their BTC and what is changing in the Bitcoin world.

- - -

We're knee-deep in the trenches where Satoshi's dream meets the gutter of reality. Hal Finney saw the future of Bitcoin when the rest of us were still fumbling around in the dark. This week, we’re tipping our hat to him while we dig into the latest moves in BitcoinFi—Bitcoin DEXs firing up on OP_NET, stBTC breaking loose on Mezo, Solv tying Bitcoin to BNB, and SatLayer locking down security like a vault.

Here’s this week’s rundown:

**🕊️ Remembering Hal Finney & His Legacy**

**🔄 Bitcoin DEX built on OP_NET**

**🚀 stBTC on Mezo unlocks Superstacked yield**

**🌉 Solv brings BitcoinFi to BNB**

**🛡️ SatLayer introduces a Universal Security Layer**

## Feature Piece: Remembering Hal Finney & His Legacy

Ten years ago today, we lost Hal Finney. If you're not familiar with the name, you should be. Finney was the guy who got Bitcoin before anyone else did. As we mark the tenth anniversary of his passing, it's worth pausing to reflect on the man whose fingerprints are all over Bitcoin's foundation. Before Bitcoin, Finney's career took him through the trenches of video game development. He then pivoted to the PGP Corporation, where he helped develop early public-key cryptography software that set the stage for his future contributions to Bitcoin.

In 2004, Finney took a significant step forward by creating the world's first reusable proof-of-work (RPOW) system—the precursor to the proof-of-work consensus mechanism we all know and love today. When Satoshi Nakamoto unveiled Bitcoin in 2009, Finney was among the first to grasp its potential. While others initially viewed Satoshi’s ideas as quixotic ramblings of an anon crank, Hal immediately recognized the spark of genius and dove in head first.

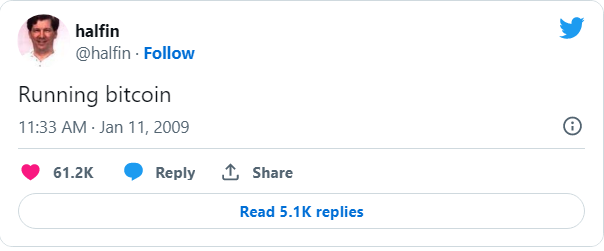

But it was in 2009 that Finney truly made his mark. As one of the first people to download and run the Bitcoin software, he recognized the beauty of self-custody of assets and started mining. That iconic moment, captured in his simple tweet—"Running bitcoin"—is often regarded as Bitcoin's "one small step for man" moment.

But life threw Finney a curveball. Even as ALS slowly robbed him of his physical abilities, he remained committed. He continued coding, using eye-tracking software when he could no longer use his hands. In 2013, Finney wrote on the Bitcoin Talk Forum: "I'm comfortable with my legacy." He had every right to be.

Finney saw Bitcoin's future with startling clarity. As he poignantly [put](https://bitcointalk.org/index.php?topic=2500.msg34211#msg34211) it, "Bitcoin itself cannot scale to have every single financial transaction in the world..." He envisioned a future where an entire financial ecosystem would be built on Bitcoin, creating a "secondary level of payment systems which is lighter weight and more efficient." In essence, Finney foresaw what we now call BitcoinFi. He understood that in order for Bitcoin to become a global reserve currency, it needed to be culturally relevant as “high-powered money”.

Ten years on, Finney's legacy is alive and kicking. Every time you make a Bitcoin transaction, you build on the foundation he helped lay. As we watch the BitcoinFi ecosystem unfold, we're seeing the realization of Finney's early predictions.

## BitcoinFi Updates

### Bitcoin DEX built on OP_NET

Liquidity pools are the backbone of any DeFi product and [MotoSwap](https://x.com/MotoswapBTC) is bringing DEX functionality to Bitcoin. Using OP_NET, it enables liquidity pool creation, token deployment, and trading directly on the Bitcoin network. Users can engage in liquidity mining and other DeFi operations without intermediaries, keeping full control of their assets.

MotoSwap subscribes to the “fat app” thesis, which argues that value should accrue to applications built on the base layer rather than requiring the base layer itself to capture additional value. In this model, Bitcoin remains the robust, foundational protocol, while MotoSwap leverage Bitcoin’s inherent security and user base to build valuable, user-centric services.

### stBTC on Mezo unlocks Superstacked yield

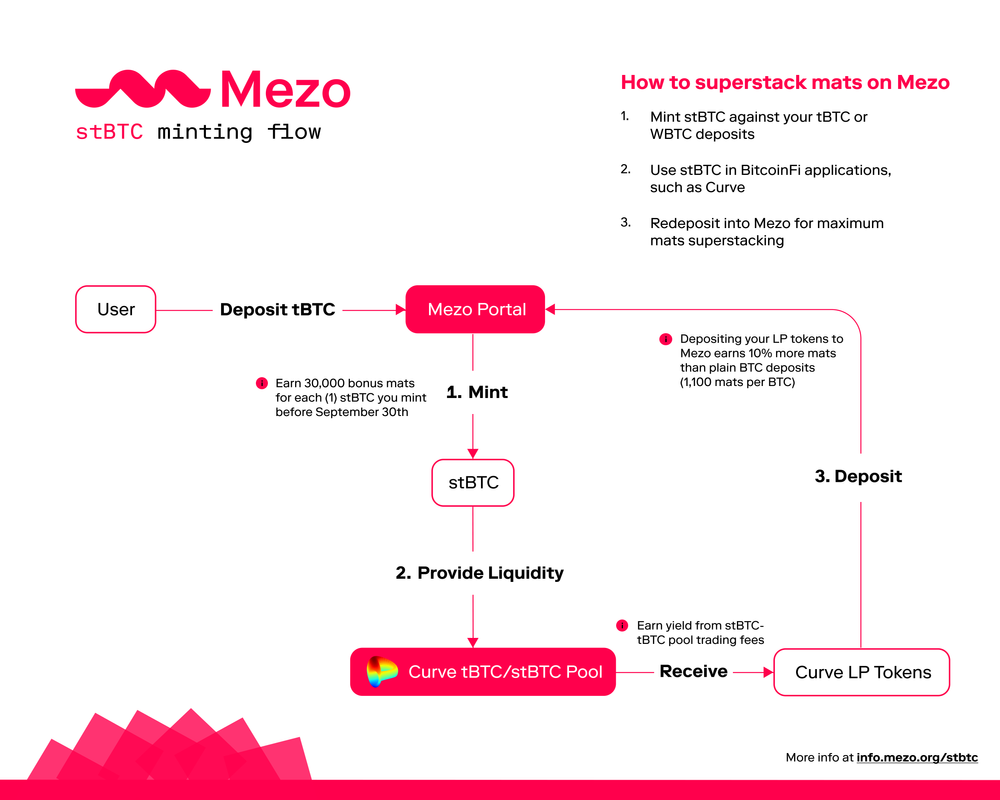

stBTC, powered by Acre, has officially launched on Mezo. This new offering allows users to mint stBTC against their tBTC and WBTC deposits, effectively providing an "early unlock" of Bitcoin locked in Mezo. stBTC is designed for capital efficiency, enabling users to earn yield in DeFi while still accruing “mats” (Mezo’s reward).

The minting process is straightforward: stBTC is minted against your existing tBTC or wBTC deposits on Mezo. Once minted, stBTC can be used across various BitcoinFi applications, such as providing liquidity to the Curve tBTC/stBTC pool. By doing so, users earn Curve LP tokens, which can be deposited back into Mezo to receive a 10% premium in mats over regular BTC deposits. This process not only boosts your yield but also enhances the overall liquidity and stability of the BitcoinFi ecosystem.

The non-rebasing nature of stBTC means that as rewards accrue, the value of your stBTC increases relative to BTC, providing a steady appreciation without altering the number of tokens you hold. For more information on how to mint and superstack your yield, check out this [blog](https://blog.mezo.org/acres-liquid-staked-bitcoin-stbtc-is-live-on-mezo/).

### Solv brings BitcoinFi to BNB

The BitcoinFi ecosystem continues to expand, with Solv integrating Bitcoin with the BNB Chain through BTCB, a tokenized version of Bitcoin. ith over 10,800 BTCB staked and more than 3,900 BTC locked in Solv’s Liquid Staking Tokens—SolvBTC.BBN and SolvBTC.ENA—it is rapidly becoming BitcoinFi central on the BNB Chain.

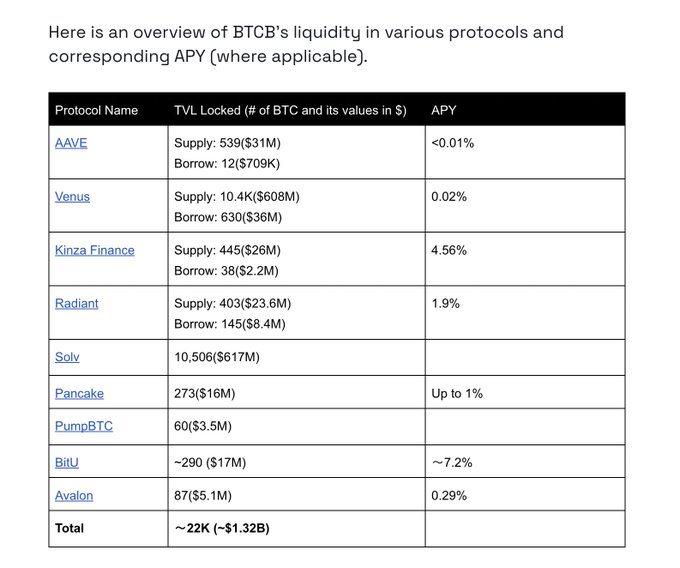

BTCB, created through a process called "wrapping," allows Bitcoin holders to mint an equivalent amount of BTCB on the BNB Chain, maintaining a 1:1 peg with Bitcoin. Users can leverage BTCB for lending, borrowing, yield farming, minting stablecoins, and providing liquidity in trading pools. This versatility has contributed to BTCB's total value locked across various protocols reaching approximately 22,000 BTC ($1.32B). Alas, this is yet another custodial approach, where Binance holds user deposits in a multi-signature cold storage wallet.

What’s interesting to note is, SolvBTC has already become the largest reserve pool for BTCB.

### SatLayer introduces a Universal Security Layer

SatLayer is building on top of Babylon to secure Bitcoin Validated Services (BVS). For those holding idle Bitcoin, SatLayer offers an opportunity to use that BTC to secure dApps and infrastructure on Babylon. By depositing liquid staking tokens (LSTs) into SatLayer, users can restake their BTC to secure BVSes such as bridges, rollups, and oracles, similar to how Eigenlayer operates on Ethereum.

The process involves depositing Wrapped Bitcoin or Liquid Staked Bitcoin, receiving a receipt token, and then restaking that token within the SatLayer app to begin earning rewards. The first season of deposits is capped at 100 BTC.

## Closing Thoughts

They say a man dies twice—once when he stops breathing, and again when his name is spoken for the last time. But Hal Finney? He’s still very much alive, living in every line of code, every block mined, every transaction sent. The man saw the future, even when the rest of us were still squinting at the horizon. Ten years on, Bitcoin keeps spinning, building, and dreaming—just like he did. Maybe that’s the real legacy here: a relentless drive to push the boundaries, to never settle for what is, but to reach for what could be.

Thank you for tuning in to this week’s BitcoinFi Weekly. See you next week.

- - -

If there's a topic you’d like us to cover or have questions, reach out at [[email protected]](mailto:[email protected]).

Learn more about Mezo at the following channels:

👾 Discord:[ https://discord.mezo.org](https://discord.mezo.org/?ref=blog.mezo.org)

🕊 X:[ https://twitter.com/MezoNetwork](https://twitter.com/MezoNetwork?ref=blog.mezo.org)

🖥 Website:[ https://mezo.org](https://mezo.org/?ref=blog.mezo.org)

🏦 Deposit Portal:[ https://mezo.org/hodl](https://mezo.org/hodl?ref=blog.mezo.org)

ℹ️ Docs:[ https://info.mezo.org](https://info.mezo.org/?ref=blog.mezo.org)

Sign up for the Thesis* newsletter

You&aposll receive blog posts about company building, crypto, and more in your inbox, about twice per month.