March 12, 2024

Bitcoin excels in certain areas—serving as a decentralized, easily accessible, and secure network for the world’s hardest money is one of them. However, serving as the foundation for an extensive decentralized application ecosystem is not one. This is where Ethereum and a variety of Alt-L1s have stepped in to capture the market looking for these dApps.

The reasons for this boil down to Bitcoin’s UTXO system, which is inhibitive to development in contrast with Ethereum’s account-based system. That isn’t to say it’s impossible to develop in the UTXO ecosystem; it’s just that EVM and other, more performance-focused execution environments, offer greater flexibility and tools, and are more widely adopted by users.

But Bitcoin has jumped back into the discussion when it comes to application development, thanks in part to [metaprotocols](https://botanixlabs.xyz/en/blog/bitcoin-metaprotocols-and-the-botanix-evm#:~:text=Bitcoin%20metaprotocols%20have%20shown%20us,Bitcoin%20network%20is%20picking%20up.) and a renewed interest in scaling Bitcoin. But despite all the Bitcoin buzz, many people are likely wondering...where are the Bitcoin dApps?

## Metaprotocol Primitives

In this new era of ‘Building on Bitcoin’, several metaprotocols have popped up to create the same types of utility EVM dApps offer, but all built on the Bitcoin base layer.

At a high level, metaprotocols enable BRC-20 and Ordinal trading, aiming to expand Bitcoin’s capabilities beyond the sending and receiving of BTC into both fungible and non-fungible token protocols. The wide appeal of DeFi applications lies in their trustless and permissionless accessibility, so it’s natural to see the appeal of building directly on Bitcoin itself, which features the same traits.

However, Bitcoin lacks the expressibility to host a robust dApp ecosystem due to the basic nature of the network’s scripting language. Still, efforts continue to work around these limitations, which is why there has been solid activity in various Bitcoin metaprotcols.

Despite the bullishness of strong developer and user activity that we cover below, Bitcoin metaprotocols are not the endgame for Bitcoin app development, but instead set the stage for a promising market of L2 dApp ecosystems.

### Ordinals

In the case of Bitcoin Ordinals, arbitrary data like a jpg file or code is inscribed to an individual or group of satoshis, the smallest units of BTC, by using additional space in Bitcoin transactions. Proposed by Casey Rodarmor in 2023, the protocol uses the network’s [Taproot upgrade](https://www.ledger.com/academy/glossary/taproot) to accomplish this feat.

It’s important to note that Ordinals themselves represent a rather significant and unintended result of the Taproot upgrade implemented in 2021. Taproot aimed at enhancing scalability and privacy, and reduced transaction costs on the network through a technical update that introduced Schnorr signatures and Merkelized Abstract Syntax Trees (MAST). By reducing the space complex transactions take on the blockchain, Taproot made way for the inscriptions protocol to take flight.

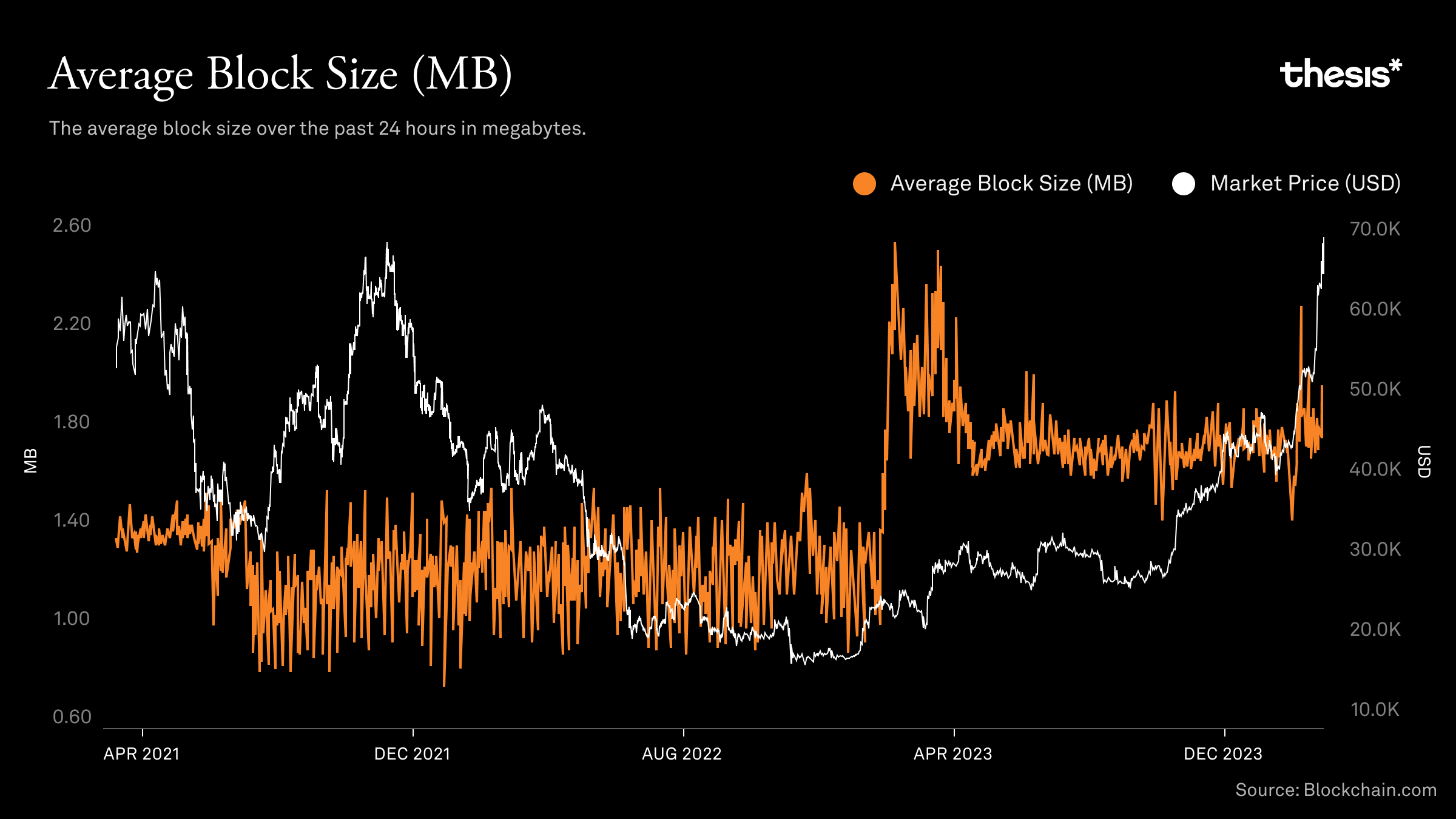

And since launch, Ordinal demand has been remarkable: just over 62 million Ordinals and [counting](https://dune.com/dgtl_assets/bitcoin-ordinals-analysis) are inscribed on Bitcoin, and over $432m worth of BTC has gone towards fees associated with inscription costs, providing a significant form of revenue for Bitcoin miners. This heavy use of Bitcoin transactions to inscribe Ordinals marked a notable increase in the amount of data used per block on the network, leading to debate over whether the protocol appropriately utilizes blockspace.

### BRC-20

The [BRC-20 token standard](https://www.brc-20.io/) is an effort to circumvent Bitcoin’s lack of smart contract functionality to issue ERC-20-like fungible assets (the only similarity between the two is the name), and also builds on the concept of Ordinals. These tokens employ JSON files to append data on Satoshis detailing token attributes such as name, symbol, and total supply.

Like Ordinals, the BRC-20 tokens require specialized wallets for storage and management, and the transactions supporting them are more complex and [space-consuming](https://twitter.com/Narbashx/status/1745517924876423283) than traditional Bitcoin transactions, again leading to concerns over congestion and higher fees as demands for blockspace increase.

Further, BRC-20 tokens lack the same level of security as BTC, since they rely on centralized off-chain indexers to process and record balance information from JSON inscriptions in an off-chain database, presenting [risks](https://www.certik.com/resources/blog/7vy7jA7QaS4eWzQx4NX6ef-ordinals-and-the-brc-20-standard-overview-and-risk-analysis) around token balance indexing errors.

In terms of accessibility, BRC-20 tokens also fall short of what users look for in fungible tokens—trading and transferring them is similar to NFTs, and there isn’t a straightforward mechanism for dividing the tokens from the batches in which are they generally initially inscribed. The most widely used BRC-20 marketplace, [Unisat](https://unisat.io/brc20), exhibits these pain points as the transfer of these assets across it resembles more the buying and selling of NFTs than a decentralized exchange, regardless of the aspirations of BRC-20 tokens.

Despite a lack of readily available infrastructure to support BRC-20 tokens, they account for a [$6b market cap](https://dashboard.brc20.com).

### Motoswap

Beyond the Ordinals and BRC-20 protocols are development efforts to expand the UTXO space. [Motoswap](https://twitter.com/MotoswapBTC) is essentially a Uniswap clone, built on the CBRC-20 protocol, which is a more flexible protocol than BRC-20 that similarly rests atop off-chain signals, with Bitcoin as the base layer.

However, demonstrations of this AMM show the underlying issue of long time-to-finality on the Bitcoin network. This makes it difficult to imagine how any application will be capable of competing in an ecosystem where it is possible to build the same functionality in a more readily adoptable medium—a BTC L2 with EVM compatibility.

### MultiBit

[MultiBit](https://twitter.com/Multibit_Bridge) intends to act as a cross-chain bridge for BRC-20 protocols to tap into EVM network liquidity. The protocol issues unique addresses to BRC-20 depositors from which it collects and vaults tokens with a unified cold wallet. Once deposits have been verified, an equivalent is minted on Ethereum, BNB Chain, or Arbitrum.

Most of the attention with Multibit is on its ecosystem token, $MUBI, but it has nearly processed $500m in volume. Upcoming product launches include an AMM with automated farming for liquidity providers and an NFT bridge for Bitcoin <> Ethereum.

The main inhibitor to this product reaching significant adoption is the fact that gas fees need to be paid on two of the most expensive blockchain networks—Bitcoin and Ethereum—to use it.

### Bitmap Tech

[Bitmap Tech](https://twitter.com/BitmapTech) manages to roll everything the burgeoning UTXO development space has to offer in a single package:

* Bitmap Explorer—a gaming metaverse where users socialize or trade their Bitmap Ordinals.

* BRC-420—a protocol that facilitates the creation, deployment, and tokenization of composable modules via inscriptions.

* Recursiverse—a series of scalable recursive applications living on Bitcoin, such as Recursive Doodinals and Recursive BBS. There is also a form for users to upload their artwork.

* Project M—an aspiring Bitcoin scaling solution remains shrouded.

### Trac Systems

[Trac Systems](https://twitter.com/trac_btc) is branched across three protocols aspiring to build directly atop the Bitcoin layer.

* Trac Core—positioned to be released as an open-source oracle, this protocol also serves as an indexer for Bitcoin’s data by fetching, organizing, and reporting updates to the blockchain via APIs.

* TAP Protocol—a Bitcoin financial hub for swapping, staking, providing liquidity, Token Authentication for potential in-game currencies, batched transactions, support for multiple asset standards, and a way to link Ordinals to fractionalized ownership frameworks. All this is tied together internally via a $TRAC governance token.

* Pipe Protocol—a means to support buying, selling, transferring, inscribing, or otherwise creation of NFTs, and other digital arts.

### Not Quite the Future of Finance

The nature of the development space surrounding Bitcoin is to strive to push boundaries, and metaprotocols provide a fine example of this. While the projects mentioned above have made a strong case that Bitcoin *can* be innovative, the long-term prospect of these protocols cannot compete with functional L2s that are coming. Development and user activity on Stacks and Rootstock are stronger than ever, and the new waves of L2s will only strengthen the case against metaprotocols.

While the foundational protocols, such as Ordinals and BRC-20s, will stand the test of time for the new frontiers they brought about, the complications of more 'functional' metaprotocols and their lack of practical performance leave the playing field open for other Bitcoin-based applications.

## What about Alt L1s?

Alternative L1s like Solana, Aptos, and SUI have carved out significant niches within the ecosystem, facilitating a broad range of experimentation, from NFTs to sophisticated DeFi, lending, and staking protocols. These networks became popular due to the lack of feasibility in developing directly on Bitcoin. As building on Bitcoin becomes more feasible, it makes less sense for a wide span of L1 networks to proliferate.

Some L1 networks serve a viable purpose with use cases that make sense—Solana’s emphasis on high throughput and low transaction costs makes it capable of boasting up to 65,000 transactions per second in optimal conditions. The network also branched out into mobile-first dApps with the introduction of crypto-first cellular phones with the [Saga mobile phone](https://two.solanamobile.com/).

However, a heavy focus on throughput has led the network to [suffer downtime](https://www.theblock.co/post/276237/solana-network-restarts-after-outage-that-lasted-five-hours) on [several occasions](https://www.theblock.co/post/215235/solana-network-back-online-following-second-restart), due to the extra pressure such levels of throughput put on nodes to maintain sync.

[Aptos](https://twitter.com/Aptos) has garnered attention due to its scalability and the flexibility of its Move programming language. However, the network’s Proof of Stake Byzantine Fault Tolerant consensus model is yet untested at scale, presenting potential challenges.

[Sui Network](https://twitter.com/SuiNetwork) is also using the Move language, with a differentiated approach focusing on customizable digital assets: the network uses object-centric global storage where addresses represent Object IDs—Objects on SUI have globally unique IDs, and SUI has module initializers, that only execute once when published. Unlike Ethereum's transactions that can change any account's storage, Sui transactions list their needs using unique IDs upfront, allowing many to be processed at the same time if they don't interfere with each other.

While various L1s are innovating to address blockchain infrastructure challenges—aiming to support a larger volume of transactions and facilitate dApp development—they face inherent hurdles. The most significant is to sustain user engagement as initial incentives wane and overcome the relative fragmentation of their user bases.

Contrastingly, Bitcoin stands as a pillar, distinguished by its foundational status, unparalleled stability, extensive years-long stress testing, and a robust, nearly 190-million-strong user base. This vast and unified community offers a significantly broader reach for any Bitcoin-based application ecosystem, unmatched by any alt-L1.

So even as Bitcoin necessitates a secondary economic layer to accommodate diverse transaction needs, its inherent advantages solidify its position as the optimal foundation for developing a dApp ecosystem.

## Bitcoin L2s are the answer for dApps

Transcending the “technically possible but clunky” designs of UTXO-based dApps, Bitcoin L2s offer a much more fertile ground for developing a dApp ecosystem.

In part due to their ability to support EVM-compatible architectures, Bitcoin L2s are a natural development ground. The merits of EVM are worth acknowledging; among active multichain developers, 87% are working on at least one EVM chain. Even in the 2023 bear market, Ethereum itself led the charge by attracting the lion’s share of new developers at 16,700 inductees to the ecosystem.

When a Bitcoin L2 supports EVM, it opens the floodgates to a large active base of developers who can easily copy and paste their existing codebases into the new chain with minor adjustments compared to rebuilding an app to work according to the new logic of different coding languages.

The user base of EVM-compatible chains is vast, with millions of unique addresses interacting with dApps across these networks. BNB Chain [estimate](https://blog.tenderly.co/2023-evm-network-landscape-report/) showed daily active wallets peaking at over 2 million, indicating the immense scale of user engagement within just one of the EVM-compatible ecosystems.

Some [valuable perspectives](https://x.com/MohamedFFouda/status/1764744376305987921?s=20) from the [Alliance DAO](https://twitter.com/QwQiao/status/1763883526376583532) team, who is at the forefront of blockchain development working with early-stage teams, share that Bitcoin development will play a large part in this cycle.

## Additional Features of a Bitcoin L2

### Performance Enhancements

* **TPS**: L2 solutions significantly increase TPS beyond the capabilities of most L1 blockchains. For example, while Ethereum's base layer processes 15-30 TPS, L2 solutions like Optimism and Arbitrum can scale to thousands of TPS, contingent on the specific implementation and network conditions. The same can be done for Bitcoin scaling networks, creating a more efficient layer.

* **Finality**: L2s can reduce the time it takes for a transaction to be considered final and irreversible. This is achieved through various mechanisms, such as state channels or rollups, which can provide near-instant finality compared to the longer confirmation times on Bitcoin which is unsuitable for the necessities of a dApp layer.

* **Cheaper**: By offloading transactions from the base layer, L2 solutions can significantly reduce gas fees, making transactions cheaper for end-users. This is particularly beneficial for applications requiring high transaction volumes with minimal fees.

* **Interoperability**: Programmable L2s built on Bitcoin can support the broader utility and flexibility of dApps through cross-chain interconnectivity. Interoperable Bitcoin L2s can seamlessly exist in a multi-chain world, where Alt-L1s have niche use cases and a small network of users.

The Bitcoin dApp layer thrives not directly on the Bitcoin network itself, but by connecting to Bitcoin through a Bitcoin-first L2. When that L2 attends to the needs of an existing robust developer base with EVM support and carries forth the core tenets of Bitcoin’s security and accessibility model, it will usher in an era of decentralized productivity for Bitcoin app developers.

Sign up for the Thesis* newsletter

You&aposll receive blog posts about company building, crypto, and more in your inbox, about twice per month.