Bitcoin Lending Market Analysis Q3 2025

A Report by:

Thesis*, Vaish Puri, Joey Campbell

Date:

November 12, 2025

Homes. Cars. College. The first warehouse when your side hustle becomes a real business. All of it runs on credit.

Credit turns tomorrow's earnings into productive capital today. It smooths cash flows, enables risk-taking, and raises living standards when used intelligently.

But credit has a dark side. When leverage meets greed and politics, we get bailouts, moral hazard, and an ever-expanding money supply. The Cantillon Effect (https://thesis.co/learn/bitcoin) ensures those closest to the money printer win, while everyone else watches their savings erode.

This is why the U.S. dollar cannot be reliable savings.

Bitcoin fixes this. Fixed supply. Permissionless access. No silent erosion of purchasing power. For the everyman, bitcoin is protection against monetary debasement. But bitcoin’s financial premium created a new problem: liquidity.

Early bitcoin holders bought and self-custodied, believing in peer-to-peer electronic cash. Now they sit on life-changing gains—enough to buy that dream house, move closer to family, or send kids to college. New holders view it as long-term savings, eventually accumulating enough to borrow against for those same purchases.

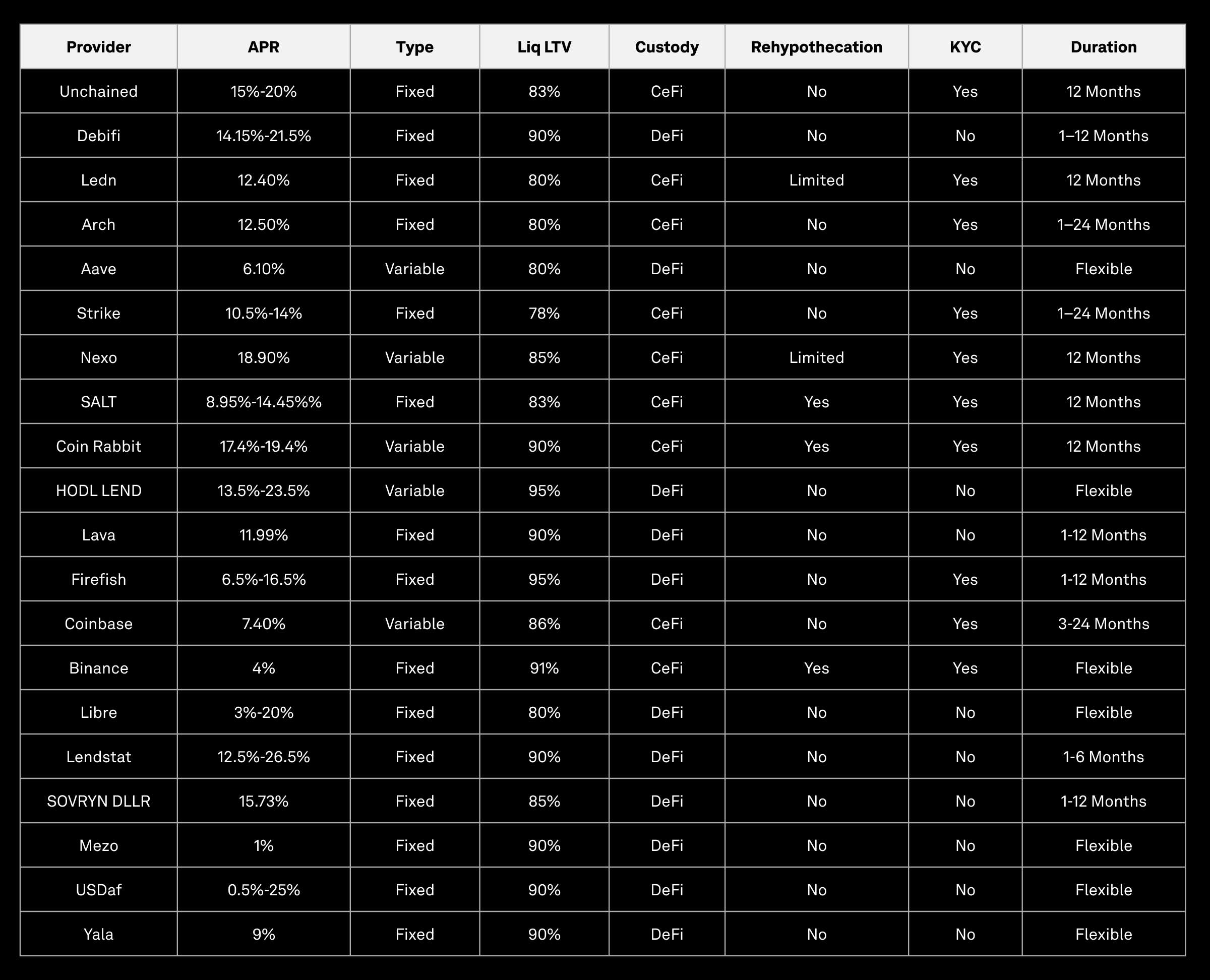

The natural extension of digital gold is a robust lending market. For years, the market struggled to figure out what fair credit looks like for bitcoin holders. Between the failure of countless of centralized entities, exorbitant rates squeezing bitcoin holders, whom they knew had no other options.

Today, that is changing. Trust minimized lending setups, that rely on dozens of custodians, rather than a single entity, distribute risk. Rates are compressing, recognizing BTC as a durable asset that deserves favorable financing rates. Lessons have been learned, and the Bitcoin lending market has turned a new leaf.

Explore the all details of the Bitcoin lending market in this report.

Download the report

Get the reportDownload the full report

Submit your email and receive the full report as well as other updates from Thesis*